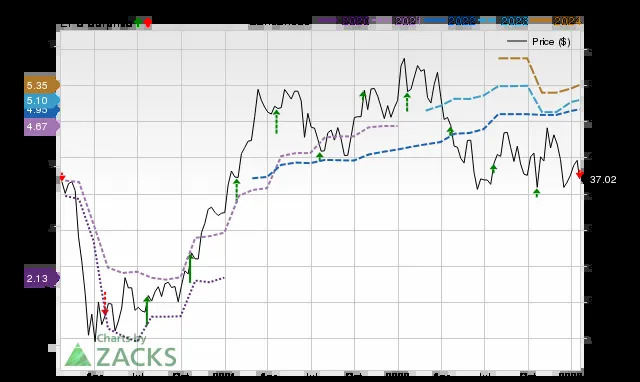

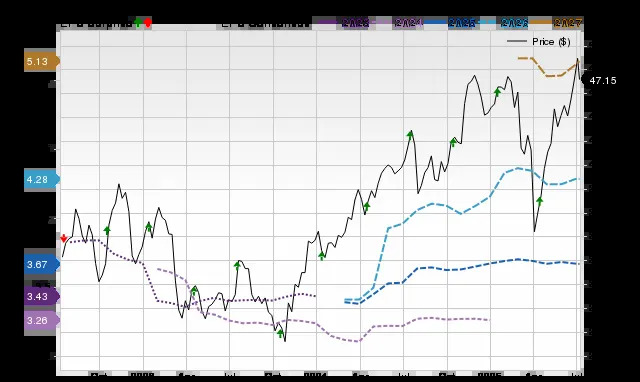

Synovus Financial (SNV) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

Synovus (SNV) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.