Nvidia Hits $4 Trillion Market Cap: Buy, Hold, or Take Profits in NVDA?

Hitting a 52-week and all-time high of $164 a share (post-split basis), Nvidia NVDA became the first company in history to reach a $4 trillion market cap on Wednesday, beating Microsoft MSFT and Apple AAPL to the punch.

Lifting the Nasdaq to a new all-time high as well, Nvidia stock is up +20% year to date and has skyrocketed more than +1,400% in the last five years.

This certainly makes it a worthy topic of whether investors should buy, hold, or take profits in NVDA after hitting such a gigantic market cap.

Nvidia’s AV Ambitions

Being the dominant chip provider in regard to powering generative and enterprise AI, Nvidia is making a bold push into autonomous vehicle (AV) production.

Making the case for keeping NVDA in the portfolio, Nvidia’s DRIVE AI Platform is now in full production, offering a full-stack software suite that supports everything from surround perception to automated lane changes and parking for Level 2++ Vehicles (Advanced Driver Assistance) and Level 3 Vehicles (Conditional Automation).

More intriguing, Nvidia already supports Level 5 fully autonomous vehicles from a technology standpoint through its DRIVE AGX Pegasus platform, which is designed to enable full autonomy for robotaxis and driverless delivery vehicles. While no country currently allows unrestricted Level 5 vehicles on public roads, Nvidia has built a powerful ecosystem of partners across the AV industry, including the likes of General Motors GM , Toyota Motor TM , Mercedes-Benz, Volvo VLVLY , and TTM Technologies’ TTMI Jaguar Land Rover, among others.

Tracking Nvidia’s Outlook

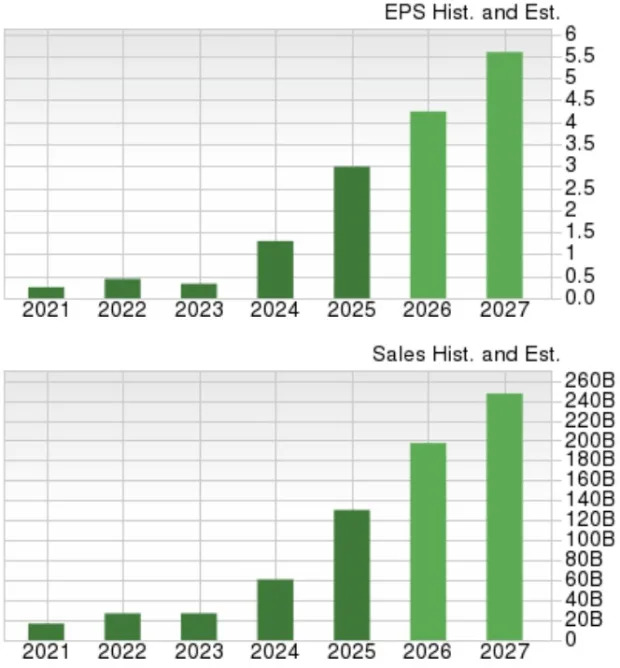

Based on Zacks' estimates, Nvidia’s total sales are expected to soar 51% in its current fiscal year 2026 to $197.54 billion from $130.5 billion in FY25. Plus, FY27 sales are projected to increase by another 25% to $247.24 billion.

On the bottom line, Nvidia’s annual earnings are slated to soar over 40% in FY26 to $4.24 per share compared to EPS of $2.99 in FY25. More impressive, FY27 EPS is forecasted to spike another 32% to $5.59.

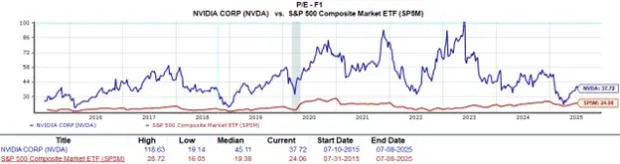

Monitoring Nvidia’s P/E Valuation

At current levels, NVDA trades at a 37.7X forward earnings multiple, which is not an overly stretched premium to the benchmark S&P 500 and offers a 17% discount to its decade-long median of 45.1X while being well below its high of 118.6X during this period. Furthermore, Nvidia is trading near its mega-cap peers, with Microsoft at a 33.1X forward earnings multiple and Apple at 29.5X.

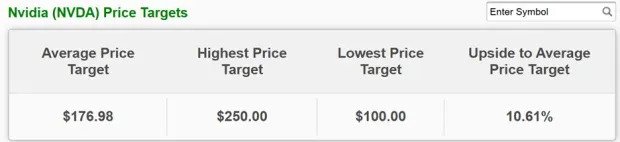

Nvidia’s Average Zacks Price Target

Based on short-term price targets offered by 42 analysts, the Average Zacks Price Target for Nvidia stock comes to $176.98, suggesting 10% upside from its previous closing price of $160 a share and 8% higher than its all-time peak of $164.

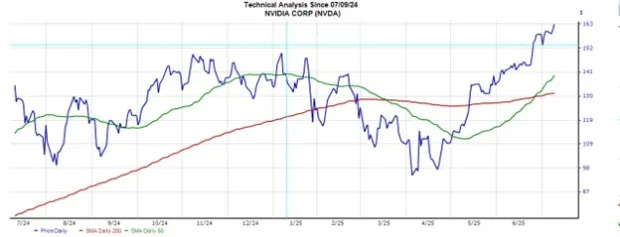

NVDA Technical Analysis

Correlating with an uptrend following the broader market's historic rebound and setting up a bull run, Nvidia’s 50-Day Simple Moving Average (Green Line) has continued to climb above its 200-Day SMA (Red Line), initially intersecting at around $129 a share and are now at $137 and $131, respectively.

Conclusion & Final Thoughts

After soaring more than +50% in the last three months and hitting a gigantic $4 trillion market cap, Nvidia stock currently lands a Zacks Rank #3 (Hold). Although it may be tempting and wise to take some profits if needed, it certainly makes sense to keep NVDA in the portfolio from a long-term perspective.

To that point, Nvidia stock is fairly valued, and its growth and technological dominance are spilling over into the future of AV production.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Toyota Motor Corporation (TM) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

TTM Technologies, Inc. (TTMI) : Free Stock Analysis Report

AB Volvo (VLVLY) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research