Japan, South Korea Stocks Gain as Trump Extends Tariff Deadline

(Bloomberg) — Japanese and South Korean equities rose Tuesday on cautious hopes that the countries can reach trade deals ahead of US President Donald Trump’s newly extended tariff deadline.

The blue-chip Nikkei 225 ( ^N225 ) gained 0.3%, with Japan’s broader Topix closing 0.2% higher after Trump sent letters to his counterparts in Tokyo and Seoul threatening levies of 25% beginning Aug. 1. Korea’s Kospi ( ^KS11 ) advanced 1.8%, the most in two weeks.

“The 25% tariff level is definitely high, but I think there’s still a sense of optimism” that Tokyo can clinch a deal with Washington now that the deadline has been extended from the original July 9, said Yusuke Sakai, a senior trader at T&D Asset Management.

For Korea, too, “we now see a ‘July deal’ back on the table,” wrote Morgan Stanley economist Kathleen Oh in a note.

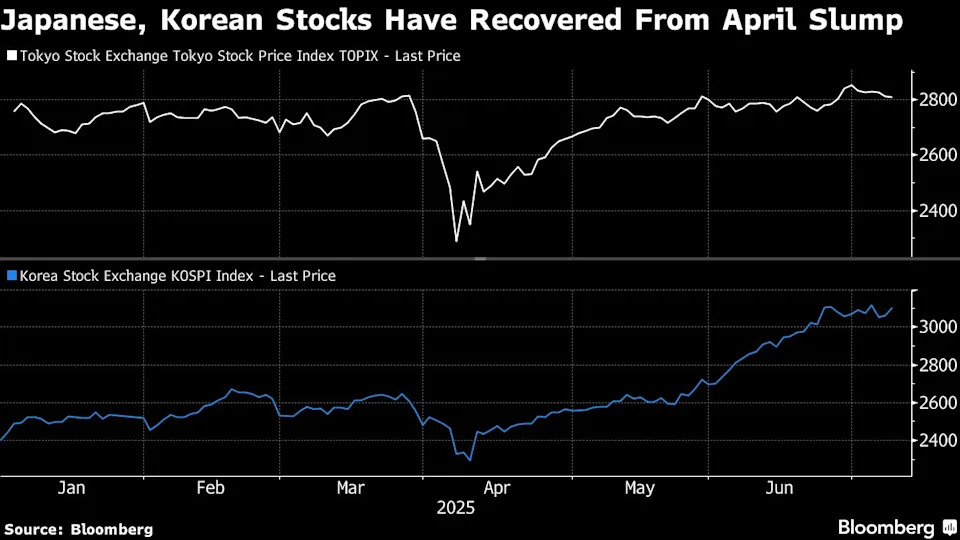

Despite the turmoil that Trump’s stance on trade has brought to markets, Japanese and Korean shares have rebounded from the lows set in April in the wake of the president’s “Liberation Day” tariff onslaught.

The recovery reflects bets that Japan, Korea and other trading partners will be able to reach deals with the US that don’t derail economic growth.

Trump threatened Japan with levies as high as 35% last week, so the 25% level may be a relief for some investors, said Masayuki Doshida, senior market analyst at Rakuten Securities.

“The market reaction would have been different if the tariff on Japan had been set at 30%,” said Doshida, “but 25% is little different from the original rate” of 24%, which Trump announced in April.

Tech-related names like Furukawa Electric Co. ( 5801.T ) and Rohm Co. ( 6963.T ) were among the Nikkei’s biggest gainers Tuesday, while in Korea, disappointing preliminary earnings from Samsung Electronics Co. ( 005930.KS ) did little to dent sentiment.

“Investors will continue to favor the sectors that have growth prospects regardless of tariffs, such as AI and tech,” said Doshida.

The yen weakened as much as 0.3% Tuesday, supporting exporters like automakers. The won advanced, recovering most of its overnight losses.

Trump’s new deadline may have boosted stocks Tuesday, but the near-term outlook for Japan and Korea remains murky, said Phillip Wool, head of portfolio management at Rayliant Global Advisors Ltd.

“Markets have basically forgotten about the stress of early April, though nothing about the Trump administration’s trade policy has actually been solved — the pain has just been potentially deferred,” he said.

“That makes US stocks, Japanese stocks and Korean stocks vulnerable whenever it seems like this could keep dragging on,” Wool added.

—With assistance from Aya Wagatsuma, Hideyuki Sano, Jaehyun Eom and Momoka Yokoyama.