Tempus AI Revenues & Profit Rise: What to Expect Ahead of Q2 Release

Tempus AI TEM is entering a phase of strong operating momentum, backed by significant acceleration in both revenues and gross profit. This trend became particularly clear in the company’s last two reported quarters, which showed Tempus AI’s transformation from a high-growth precision medicine startup to a scalable enterprise AI and diagnostics company with improving margins and profitability trends.

Invest in Gold

In the fourth quarter of 2024, Tempus AI reported 35.8% year-over-year revenue growth, with gross profit rising 49.7%, driven by strong performance in its high-margin Data and Services segment. Momentum continued into the first quarter of 2025, as revenues grew 34% and gross profit climbed 45%, lifting gross margin from 42.5% to 44.5%. The gains were fueled by lab efficiencies, increased adoption of AI tools like Tempus One and xM and a higher mix of data services. These improvements also narrowed adjusted EBITDA losses by 61% sequentially.

The company’s upcoming second-quarter 2025 earnings release is expected to once again reflect margin expansion and sequential gains in adjusted EBITDA, driven by the adoption of new offerings such as Tempus One in EHR systems and the xM liquid biopsy assay. Any upward revision to guidance or increase in contract value, particularly from large enterprise deals, could strengthen the momentum seen in the first few months of the year. Given its strong margins and growing enterprise traction, Q2 performance could solidify Tempus AI’s position as a rare AI-healthcare company combining high growth with improving financial discipline.

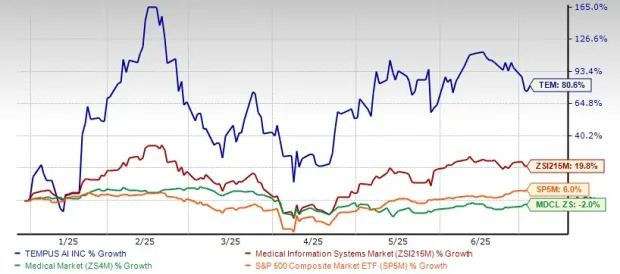

TEM Stock Outperforms Industry, Sector and Benchmark YTD

Tempus AI Peers Making Significant Strides in AI-driven Diagnostics

Guardant Health GH: As a major player in blood-based cancer diagnostics, GH recently introduced Guardant Reveal, its latest minimal residual disease assay, now available for clinical research and under coverage review by major payors. Further, Guardant Health’s Shield multi-cancer detection test recently received FDA Breakthrough Device designation, highlighting its strong clinical potential and regulatory momentum. In the first quarter of 2025, improved test sensitivity and cost efficiencies led to positive gross margins for both Reveal and Shield assays.

Natera NTRA: It posted strong first-quarter 2025 results with 36.5% revenue growth and gross margin expansion to 63.1%. Positive cash flow and expanded Medicare coverage for its Signatera MRD assay, now including NSCLC and pan-cancer immunotherapy monitoring, position Natera to tap into a new multi-hundred-million-dollar market. Backed by robust ASCO data, Natera remains a high-growth peer in personalized oncology.

Estimates for Tempus AI

The Zacks Consensus Estimate for Tempus AI’s 2025 earnings implies a 56.3% improvement year over year.

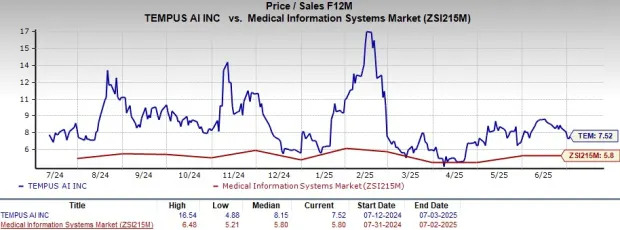

Expensive Valuation

TEM currently trades at a forward 12-month Price-to-Sales (P/S) of 7.52X compared with the industry average of 5.8X.

Tempus AI currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here .

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Natera, Inc. (NTRA) : Free Stock Analysis Report

Guardant Health, Inc. (GH) : Free Stock Analysis Report

Tempus AI, Inc. (TEM) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research