More Buying for Stock Indexes? Where Perfection Meets Reality

Ready to dive into the stock index markets and hunt for opportunities? July is shaping up to be a pivotal month for traders eyeing the Nasdaq and Dow Jones indexes. Despite the noise and negativity swirling around, historical seasonal patterns suggest a potential rally is on the horizon. Let's break down the three seasonal buying patterns for these indexes, explore their correlation with the S&P 500, assess the market's current mood, and equip you with strategies and assets to capitalize on this window. The challenge is clear: Can you identify the opportunity and take action?

Three Seasonal Bullish Patterns for July

Both the Nasdaq and Dow Jones exhibit three distinct seasonal patterns that historically align with bullish price action in July:

More News from Barchart

These patterns aren't guarantees, but their consistency over decades makes them worth watching.

S&P 500 Correlation: A Likely Co-Rally

Negativity Persists, Yet Prices Climb

Despite bullish seasonal signals, market sentiment is sour. Geopolitical tensions in the Middle East and fears of inflation keep headlines grim. Social media and financial forums buzz with bearish predictions, yet the Nasdaq and Dow continue to grind higher since the April 07 lows. This disconnect highlights a key lesson: markets don't move solely on sentiment. Prices reflect significant buying, earnings strength, and technical patterns—factors that often drown out the noise. Traders who focus on data over headlines stand to benefit.

The Power of a Trading Strategy

Guessing market moves is a recipe for losses. A strategy rooted in seasonal patterns, technical analysis, and/or fundamentals eliminates the guesswork. For July, a simple approach could involve buying index ETFs on dips before the Fourth of July and holding through mid-month earnings. It's up to each trader to use their due diligence and risk management skills before entering a trade like this to confirm it aligns with their trading style. Discipline matters—make sure to set stop-losses to manage risk. A strategy keeps emotions in check, letting you trade your plan, not the panic.

Bearish and Bullish Fundamental Factors to Watch

Bearish Risks:

Bullish Catalysts:

Assets to Trade the Seasonal Window

Traders have multiple ways to play the July rally:

Select assets that align with your risk tolerance and account size, and always employ proper position sizing to manage your investments effectively.

Moore Research Center, Inc. (MRCI) July Stock Index's Seasonal Buy

In a previous article for Barchart, "The 2025 Nasdaq Bear Market and Its Remarkable Rebound: Will the Upcoming Seasonal Window Propel It to New All-Time Highs?" I described a seasonal buy for the Nasdaq that has had a 100% occurrence rate for the past 15 years. Currently, the market has been moving sideways, perhaps waiting for the upcoming seasonal patterns to add a boost.

As a crucial reminder , while seasonal patterns can provide valuable insights, they should not be the basis for trading decisions. Traders must consider various technical and fundamental indicators, risk management strategies, and market conditions to make informed and balanced trading decisions.

In addition to the seasonal pattern in the article, there are three upcoming seasonal buys to support the potential for higher prices in July.

MRCI research has identified a trifecta seasonal pattern. What makes this trifecta significant is the high percentage of occurrences in two different markets. For markets to exhibit this kind of seasonality for 15 years, it would appear that a major fundamental event must have caused it. Leading one to believe the seasonal pattern has a good chance of repeating, but still not guaranteed.

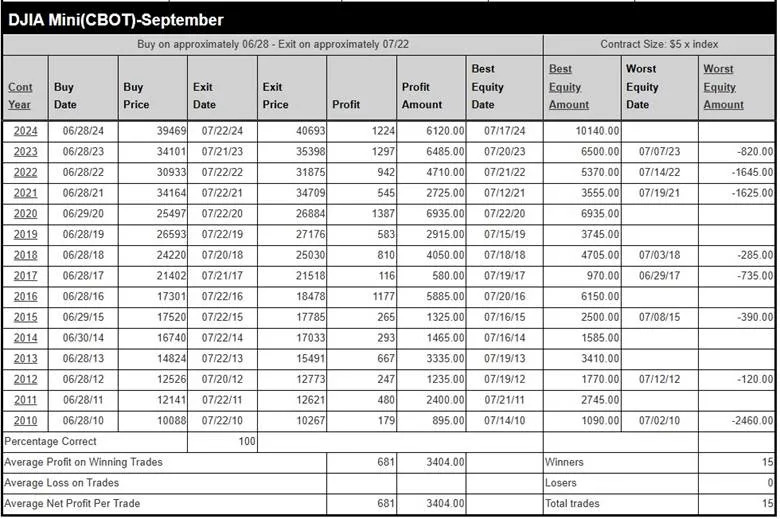

The first, MRCI research has found that the Dow Jones Index has closed higher on approximately July 22 than on June 28 for 15 of the past 15 years. Additionally, seven of those years never experienced a daily closing drawdown.

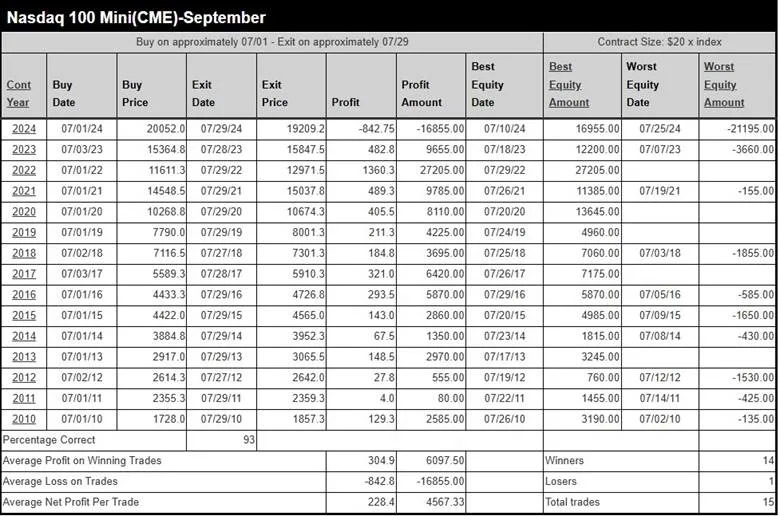

Second, MRCI research has found that the Nasdaq has closed higher on approximately July 29 than on July 01 for 14 of the past 15 years. Additionally, five of those years never experienced a daily closing drawdown.

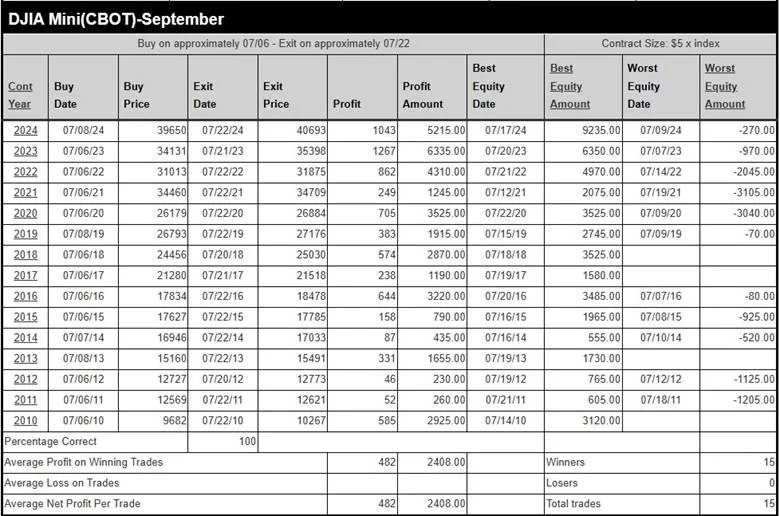

Last, but not least, MRCI research has found that the Dow Jones Index has closed higher on approximately July 22 than on July 06 for 15 of the past 15 years. Additionally, four of those years never experienced a daily closing drawdown.

In closing…

July offers a compelling setup for the Nasdaq, Dow Jones, and S&P 500, driven by three fundamental seasonal patterns. And MRCI's seasonal patterns, which have historically delivered gains. Despite the market's negative tone, prices continue to climb, rewarding those who adhere to data-driven strategies. Whether you trade ETFs, futures, options, or stocks, the opportunity is there—but it won't wait. Do your due diligence: study the patterns, backtest your strategy, and manage your risk. The market doesn't care about your fears or hopes—it rewards action. Are you ready for these opportunities?

On the date of publication, Don Dawson did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. This article was originally published on Barchart.com