Trump’s tariffs are America’s Brexit, says this strategist. These are the trades to make.

The latest market rally is remarkable. Hopes that we’re past the worst trade-war headlines saw the S&P 500 strike an eight-day winning streak, registering an 8.65% gain in the process.

Indeed, the equity benchmark SPX has now recovered most of the losses sparked by President Donald Trump’s “‘liberation day” tariff bombshell on April 2. It’s the market equivalent of Bobby Ewing in the shower : seems it was all just a nasty dream.

Unsurprisingly, there are many market observers baffled by the speed and size of the equity rebound, especially given the likelihood that data will show the U.S. economy slowing markedly in coming months.

One showing such caution is Dhaval Joshi, chief strategist for BCA Research’s Counterpoint. In a note published Thursday, he sets out why he’s wary of some U.S. assets and suggests the trades to make.

The crux of his concern is the divergent impact of Trump’s upending of global trade: that it is simultaneously inflationary for the U.S. and deflationary for the rest of the world.

That’s because Trump’s ultrahigh tariffs on China, the world’s biggest goods exporter, means the price of imports to the U.S. will rise, while Beijing’s attempts to find buyers in alternative markets will require a lowering of prices in order to sell similar volumes, Joshi says.

For bond investors, the choice is increasingly clear. The U.S. faces stagflation — slowing growth combined with tariff-induced inflation — while other major economies face the more manageable combination of slowing growth with deflationary pressure.

This creates a fundamental divergence in central-bank responses, with the Federal Reserve conflicted between addressing U.S. growth concerns and persistent inflation, limiting its ability to cut rates aggressively, which won’t help Treasurys. Meanwhile, central banks in Europe and elsewhere face no such conflict in their dual mandates, enabling more decisive rate cut, according to Joshi, which should help the continent’s bonds.

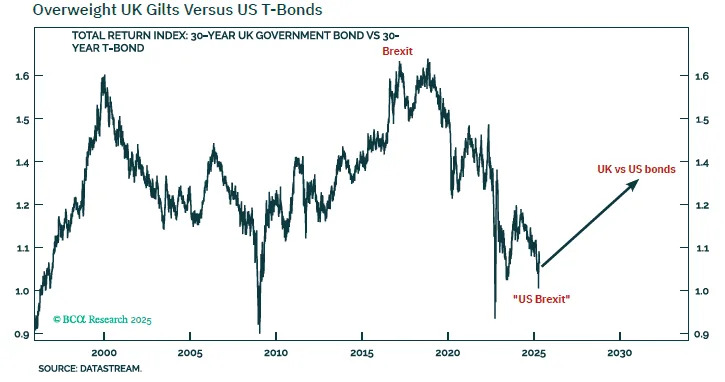

In addition, “Trump’s tariffs can be likened to ‘America’s Brexit,’ ” he says. And just as when U.K. government bonds lost cachet after the country voted to leave the European Union, now “it will be the turn of U.S. T-bonds to suffer the higher inflation rates and loss of privileged haven status.”

With U.K. government bonds likely to recoup 10 years of underperformance versus their U.S. peers, BCA says investors should overweight gilts BX:TMBMKGB-30Y versus Treasurys BX:TMUBMUSD30Y .

European equities also present a compelling value proposition against their American counterparts, but not merely as a consequence of bond-market dynamics, says Joshi. The more significant factor is the ongoing deflation of the artificial-intelligence bubble that has dominated U.S. market performance.

The AI-driven surge in U.S. tech valuations rests on two questionable assumptions: that U.S. companies will capture all productivity gains (similar to Web 2.0), and that today’s tech giants will dominate the AI era. Historical patterns suggest otherwise — “the big winners of one technology are rarely the big winners of the next technology,” he says.

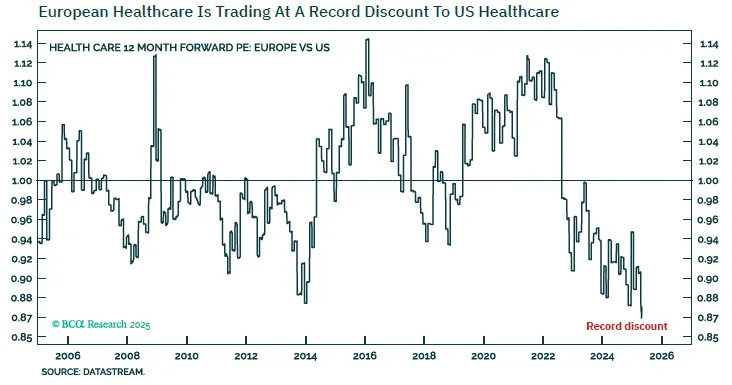

Europe’s valuation discount versus the U.S. (currently -35% versus a long-term average of -20%) represents the mirror image of this AI bubble. As this deflates, European equity benchmarks stand to benefit significantly through relative valuation adjustments.

Therefore, BCA says investors should be overweight European stocks XX:SXXP versus the U.S., particularly with regard to the healthcare sectors where Europe is trading at a record discount.

Finally, Joshi notes that signs of foreigners shedding U.S. bonds and stocks creates unprecedented pressure on the dollar, raising an intriguing question: Which currency stands to gain most from the greenback’s decline? April provided a surprising answer: bitcoin.

For the first time, bitcoin BTCUSD emerged as the primary beneficiary of capital fleeing the dollar, with its appeal stemming from its status as a nonconfiscatable asset — insurance against inflation, banking-system failures and state expropriation, BCA notes.

“The evidence since ‘liberation day’ is that investors have lost faith in the dollar as a haven asset. Investors are fleeing to gold but fleeing even more to bitcoin,” says Joshi. “In which case, my bitcoin price target of $200,000+ is way too low! Stay structurally long bitcoin.”

Markets

U.S. stock-indices SPX DJIA COMP are higher at the opening bell as benchmark Treasury yields BX:TMUBMUSD10Y rise following stronger-than-expected jobs data. The dollar index DXY is lower, while oil prices CL.1 inch higher and gold GC00 is trading around $3,262 an ounce.

|

Key asset performance |

Last |

5d |

1m |

YTD |

1y |

|

S&P 500 |

5604.14 |

2.18% |

3.85% |

-4.72% |

10.66% |

|

Nasdaq Composite |

17,710.74 |

3.17% |

7.01% |

-8.29% |

11.80% |

|

10-year Treasury |

4.206 |

-3.40 |

19.70 |

-37.00 |

-31.20 |

|

Gold |

3269.1 |

-1.84% |

6.97% |

23.86% |

41.51% |

|

Oil |

58.95 |

-6.70% |

-5.41% |

-17.98% |

-24.41% |

|

Data: MarketWatch. Treasury yields change expressed in basis points |

|||||

Need to Know starts early and is updated until the opening bell, but to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

The buzz

The April nonfarm-payrolls report showed a net 177,000 jobs were added, more than analyst forecasts of 130,000, and lower than the downwardly revised 185,000 in March. The unemployment rate was 4.2%, in line with forecasts and the same as March, while month-on-month hourly wages grew 0.2%, down from 0.3% in March.

Other U.S. economic data due Friday include factory orders for March at 10 a.m..

China said its door is open for trade talks with U.S.

Shares of Apple AAPL are under pressure as uncertainty over the impact of tariffs weighs .

Chevron’s stock CVX is falling after mixed results . Exxon Mobil XOM shares are inching higher after the oil major topped analyst estimates .

Donald Trump has proposed slashing $163 billion in government programs in his budget blueprint, according to the Wall Street Journal .

Best of the web

How Apple blew up its control over the App Store.

Something alarming is happening to the job market .

Gen Z is questioning college. Hucksters are taking advantage of them. (Contains some bad language.)

The chart

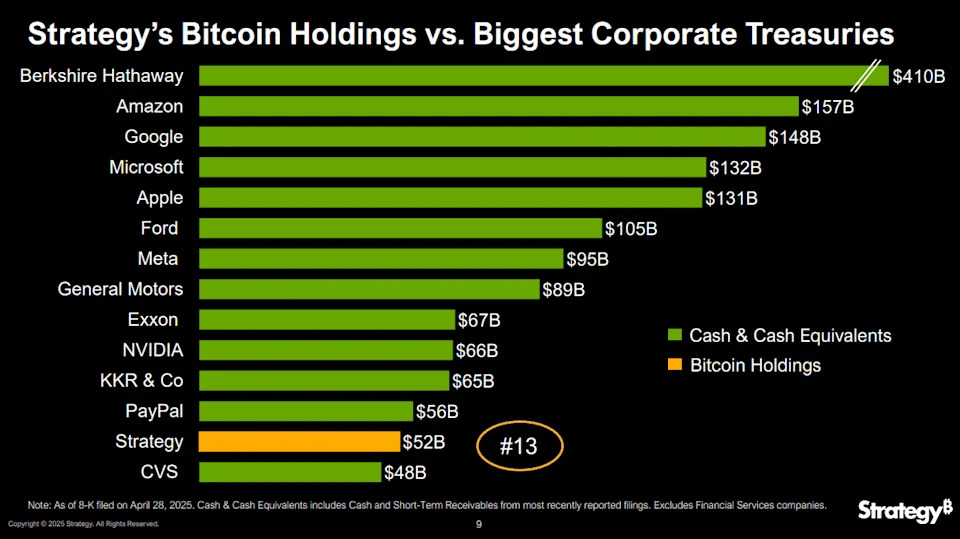

Here’s a chart from Strategy’s first-quarter earnings presentation . The bitcoin holder compared its crypto pile to corporates holding the biggest stash of cash or cash equivalents, saying it ranks 13th.

Top tickers

Here were the most active stock-market ticker symbols on MarketWatch as of 6 a.m. Eastern.

|

Ticker |

Security name |

|

TSLA |

Tesla |

|

NVDA |

Nvidia |

|

AAPL |

Apple |

|

AMZN |

Amazon.com |

|

GME |

GameStop |

|

PLTR |

Palantir Technologies |

|

MSFT |

Microsoft |

|

TSM |

Taiwan Semiconductor Manufacturing |

|

META |

Meta Platforms |

|

MSTR |

Strategy |

Random reads

A 1,000 foot UFO?

Sorry, but the bus is full.

Rockport’s vandalizing woodpecker.

It’s not looking good for those who’d like to see Donald Trump as the next pope.

Semi spills $800K in dimes, causing unfathomably annoying cleanup .

For more market updates plus actionable trade ideas for stocks, options and crypto, .