SEC defends amended suit against Binance, CZ over securities claims

The United States Securities and Exchange Commission (SEC) has responded to a motion for the dismissal of its amended suit against cryptocurrency exchanges Binance and Binance.US and former Binance CEO Changpeng Zhao alleging they operated an unregistered securities exchange. The allegation is based on the sale of ten cryptocurrencies on the secondary market intermediated with the exchange’s BNB coin.

Once more with feeling

The SEC filed an amended complaint after Judge Amy Berman Jackson in the US District Court for the District of Columbia questioned the reasoning in a complaint making the same allegations. The Binance exchanges and Zhao filed a motion for the dismissal of the complaint on Nov. 4.

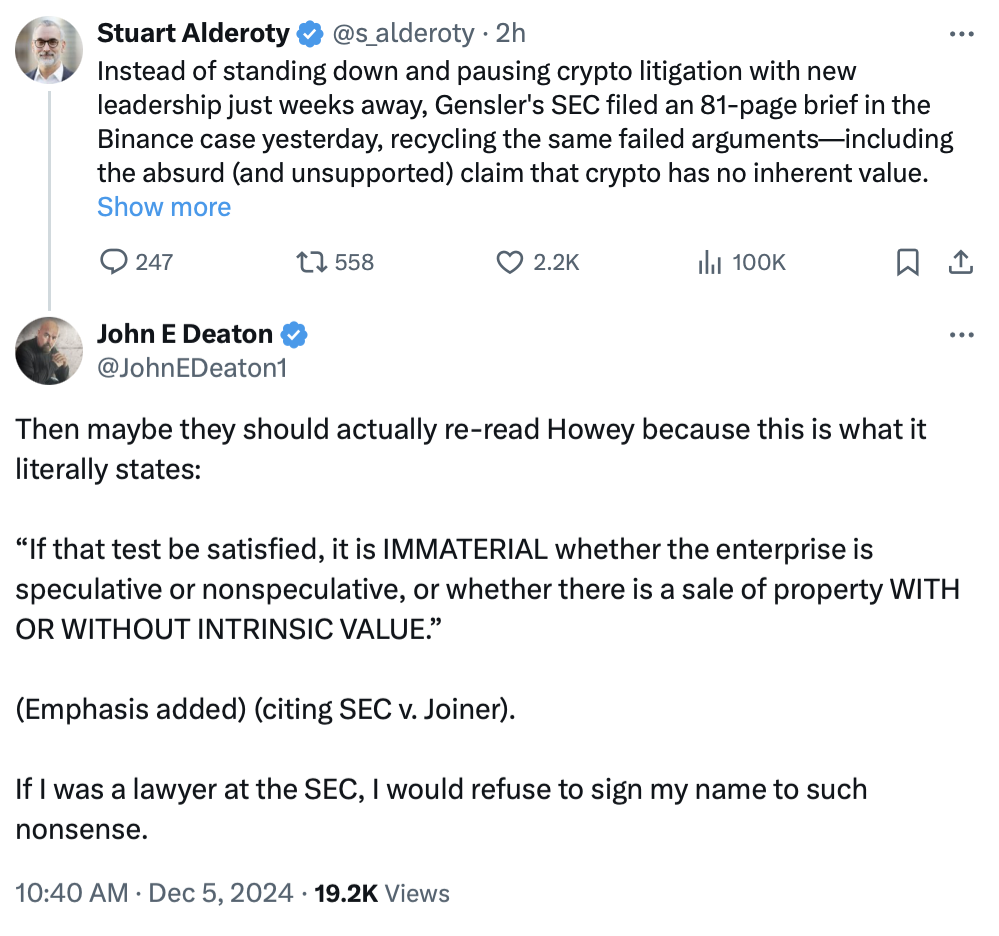

The SEC’s Memorandum of Law opposing the motion to dismiss responds to their claim that the SEC complaint does not plausibly produce facts to satisfy the Howey test. The memorandum discusses each prong of the test and reiterates the SEC’s position on them.

The Howey test was established in a US Supreme Court ruling in 1946 to identify a security .

The memorandum also adds allegations about the status of the cryptocurrencies and Binance’s BNB

“The foretold vast and purported suffocating assertion of regulatory dominion over an entire industry has not occurred, but they complain about that, too.”

Related: Trump nominates Paul Atkins to replace Gensler as SEC chair

A long and winding trial

The SEC first filed the case against the Binance exchanges and Zhao on June 5, 2023. The ten coins in question are Solana

The SEC filed suit against Coinbase on June 6, 2023, claiming that 13 tokens, offered by that cryptocurrency exchange were securities. The SEC has claimed a total of 68 cryptocurrencies are securities across all suits it had filed as of mid-2023.

Magazine: AI agents trading crypto is a hot narrative, but beware of rookie mistakes